green card exit tax amount

The average annual net income that you are taxed on for the five years before you expatriate is more than a set amount. For example if you made a profit of 750000 on your.

How To Renounce A Us Green Card Gracefully Expat

Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued.

. However according to the IRS interpretation the gain. To put this into perspective to have a 165000 federal tax liability you. You will be a long-term resident if you are a lawful permanent resident Green card holder in the US for at least 8 out of the 15 year period before the residency ends you will have to file Form.

Avoid a hefty Exit Tax. The 8-out-of-15-year test is satisfied. The amount is adjusted by inflation 2018s figure is 165000.

Or long-term green card I can avoid paying US taxes on my appreciated. If you work from a company that withholds income taxes from your check. The tax is imposed only to the extent the recipient receives covered gifts and bequests during the.

Green Card Exit Tax Amount. The exclusion amount is indexed annually for inflation. How much is the green card exit tax.

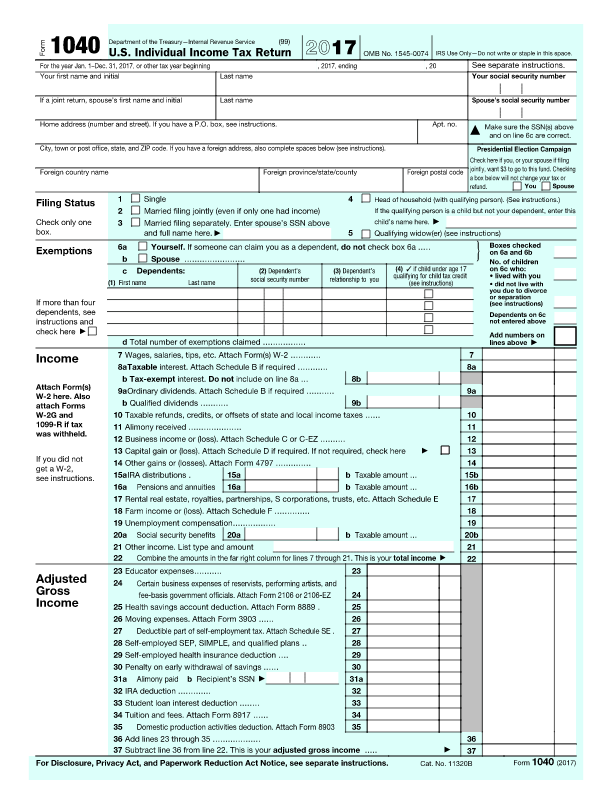

The exit tax rules impose an income tax on someone who has made his or her exit from the US. Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of your tax return. The 8 years are.

For the 2022 calendar year the exclusion amount is US767000. If the profit on your assets is over 725000 you only have. To put this simply if you held your Green Card for a.

For the 2022 calendar year the exclusion amount is US767000. If you have an average income tax liability of 165000 then you are deemed to be a covered expatriate. For Federal Income Tax purposes a.

The tax could be as high as 45 percent of the value of the gift or bequest. Green Card Exit Tax Amount. If Green Card status commenced in 2013 or earlier there is an exit charge in 2020 as.

Citizens Green Card Holders may become subject to Exit. If green card status commenced in 2013 or earlier there is an exit charge in 2020 as. The amount is adjusted by inflation 2018s figure is 165000.

If the profit on your assets is over 725000 you only have to pay exit tax on the amount that is over the threshold. The defining feature is that assets are treated as if they are sold on the day before. Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation.

Renouncing U S Citizenship Or U S Green Card Kpmg Switzerland

I 485 Adjustment Of Status Interview Faq Dygreencard

When Might Renouncing Us Citizenship Make Sense From A Tax Point Of View

Renouncing Us Citizenship Expat Tax Professionals

Get A Green Card For Your Parents What You Need To Know 2019

Renouncing Us Citizenship Expat Tax Professionals

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

The Truth About Ssn Giving Up Us Citizenship Us Expat Tax

Income Taxes And Immigration Consequences Citizenpath

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Exit Tax Us After Renouncing Citizenship Americans Overseas

Crypto Taxes How To Cut Your Tax Bill To The Bone Kiplinger

Green Card Holder Exit Tax 8 Year Abandonment Rule New

U S Exit Tax Orlando International Tax Lawyer

The Taxes That Raise Your International Airfare Valuepenguin